Churn is the Enemy of SaaS Companies

Churn is the Enemy of SaaS Companies'

By: Mohammed Alqaq

Customer churn is a major problem for companies of all sizes. It’s a problem that many businesses struggle with, and it can have a huge impact on a company’s bottom line.

Churn is the percentage of customers who stop doing business with a company over a given period of time. It’s an important figure for businesses to track, as it can provide insights into customer satisfaction and loyalty. Knowing why customers churn, and how to predict and reduce churn, can help businesses improve their customer retention and grow their customer base.

What is Churn?

Churn in SaaS (Software as a Service) companies is the process of customers canceling their subscriptions or accounts to the company.

Churn is one of the most important metrics for SaaS companies because it is a key indicator of customer satisfaction and loyalty. Churn can be measured in different and many ways, such as.

- The percentage of customers who have canceled their subscriptions over a given period of time.

- The number of lost customers over a given time frame.

- Or, It can be measured in terms of revenue.

The churn rate is an important metric because it can have a significant impact on a SaaS company’s bottom line.

A high churn rate can indicate that a SaaS company is not providing a product or service that meets customer needs, or that customers are unhappy with the product or service and are seeking alternatives.

There are several factors that can influence a SaaS company’s churn rate. These include pricing, customer service, product features, and the overall customer experience.

A SaaS company should monitor and analyze its churn rate on a regular basis in order to identify any trends or areas of concern.

For a company to expand its customer base, its growth rate (number of new customers) must exceed its churn rate (number of lost customers).

Causes of customer churn

There are many factors that can cause customers to churn, but the main ones include:

1) Poor customer service: A customer may choose to leave if they feel that their experience was not up to their expectations. This could be due to poor customer service, slow response times, or a lack of helpfulness from customer service representatives.

2) Lack of value: Customers may leave if they feel that a product or service is not worth the price they’re paying. This could be due to a lack of features, quality, or relevance to their needs.

3) Poor product or service: Customers may choose to leave if they feel that the product or service is not performing as expected. This could be due to bugs, glitches, or other issues that make the product or service difficult to use.

4) Competitor offerings: Customers may choose to switch to a competitor if they feel that the competitor’s offering is better than what they’re currently using.

5) Not understanding your target audience: customers might be looking for new features that you’re simply not providing – and that might be a new need that you’re not aware of. This could be due to a lack of customer feedback tracking, a lack of engagement with customers, and an understanding of their desired outcomes over time.

How to Predict Churn

Knowing why customers churn is important, but it’s also important to be able to predict when customers are likely to churn. This can be done through a number of methods, including:

1) Customer surveys: Asking customers directly about their satisfaction and loyalty can provide valuable insights into how likely they are to leave.

2) Analyzing customer behavior: Examining how customers interact with a product or service can provide clues into how likely they are to leave. Things to look out for include decreased usage, lack of engagement, or a sudden change in behavior.

3) Using machine learning algorithms: Companies can use machine learning algorithms to analyze large amounts of data and identify patterns that could indicate a customer is likely to churn.

How to Reduce Churn

Once a company knows why customers churn and can predict when customers are likely to churn, it can take steps to reduce the churn. Some of the most effective methods for reducing churn include:

1) Ensure that your customers are receiving the value they expect. If a customer is not receiving the value they expect, they may be more likely to leave. Companies should focus on customer experience, including customer service, product features, and ease of use.

2) Focus on customer retention. Companies should focus on finding ways to keep customers around for longer periods of time. This may include offering additional products or services that customers may be interested in, creating loyalty programs, or offering better deals to existing customers.

3) Improving product or service quality: Making sure that the product or service is performing as expected and proactively addressing customer issues can help prevent customers from leaving, and reduce churn.

4) Focus on improving customer acquisition costs. Companies often spend a lot of money on customer acquisition, but if they can reduce customer churn, they can save on those costs. Companies can focus on acquiring customers through referral programs, referrals from existing customers, or other sources.

Customer Churn vs. Revenue Churn

Customer churn and revenue churn are two terms that often go hand in hand, but there is an important distinction between them.

Customer churn is the process of customers stopping their service or subscription with a company, while revenue churn is the loss of revenue that a company experiences when customers stop their service or subscription. While customer churn is often an indicator of a company’s performance and customer satisfaction, revenue churn is the actual financial impact of customer churn.

When it comes to customer retention, customer churn, and revenue churn are both important and should be monitored closely. Understanding both customer churn and revenue churn is critical because both metrics provide value.

Using both metrics tells you how many customers have left your business and how much money these customers took with them.

Companies should strive to reduce customer churn by creating an environment where customers feel valued and appreciated, and by being proactive in reaching out to customers to ensure that they are satisfied with their experience.

With the right strategies in place, companies can reduce customer churn and revenue churn, and ensure that their customers remain loyal and engaged.

Negative Churn

Negative churn, also known as churn minus, is the process of reducing customer attrition or the rate of customer churn. It is a powerful tool for companies to use to increase customer loyalty, reduce customer acquisition costs, and even increase revenue.

Negative Churn is the dream of every SaaS company. It happens when the expansions, up-sells, and cross-sells to your current customer base exceed the revenue that you are losing because of Churn.

The goal of negative churn is to reduce customer attrition and increase customer loyalty. Companies can accomplish this by offering loyalty rewards, better deals, or other incentives. They can also focus on improving customer service or introducing new products or services that keep customers engaged.

As SaaS becomes more mature, negative churn is the key to driving amazing results.

For companies to improve their negative churn they should do one or more of the following:

- Expansion: by for example having a pricing model that increases the pricing according to usage growth;

- Up-sell: by for example moving customers to a more highly featured version of your product;

- Cross-sell: by for example driving the customers to purchase additional products or services.

Negative churn can be an effective way to reduce customer attrition, increase customer loyalty, and even increase revenue. Usually, negative churn is not easy to happen in the first 12 – 18 months of the customer journey as it is usually too early to figure it out.

Companies should focus on providing value to their customers, improving customer retention, and reducing customer acquisition costs in order to maximize the benefits of negative churn.

What’s an acceptable Churn Rate?

As low as possible is the best answer, and it likely will never be zero. And that’s okay.

Since the churn rate is an important metric that tells you how many of your customers are leaving or cancelling their services or subscription and can help you better understand why customers are leaving, so you can make changes to improve your customer experience.

But what is an acceptable churn rate, and what factors should be considered?

An acceptable churn rate is based on the size and type of business, as well as the sector and industry. According to Lincoln Murphy from Sixteen Ventures the average acceptable annual churn rate for SaaS businesses is 5-7% (translates to 0.42 – 0.58% monthly churn), though this varies greatly across businesses and industries, so in reality, there is no universal “average” churn rate.

When it comes to startup companies and SMBs, they should aim to keep their churn rate between 10%-15% for the first year and maintain a monthly churn rate below 5%.

When considering what is an acceptable churn rate, there are several factors to consider.

- The size of your customer base.

- The product or service you are offering.

- Your business sector and industry.

- The competitive landscape for your product or service.

Churn rates may be higher for products or services that require more effort from customers, such as subscription-based services.

You should evaluate your customer service. Poor customer service can lead to higher churn rates, as customers may feel frustrated or disappointed with their experience. Focus on providing a positive customer experience, and make sure to respond quickly to customer queries and complaints.

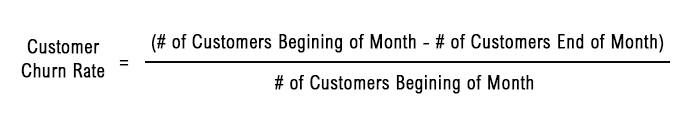

How to calculate Churn?

Churn is an important metric for any business, as it provides insights into customer satisfaction and retention. As such, it is important to understand how to calculate churn rates so that businesses can identify and address areas for improvement.

The formula for calculating the churn rate is simple:

To calculate churn rate, businesses must first identify the total number of customers they had at the beginning of the period they want to measure. This number will be the denominator of the formula. Then, businesses must determine the number of customers that left during that same period. This number will be the numerator of the formula.

It is important to note that the churn rate can be calculated for different time periods. For example, a business can calculate its churn rate for a month, quarter, or year. Additionally, businesses can calculate their churn rate by customer segment, allowing them to better understand the specific customer groups that are leaving.

By understanding how to calculate churn rate, businesses can get a better understanding of customer satisfaction and loyalty. This information can help businesses identify areas for improvement and take action to increase customer retention.

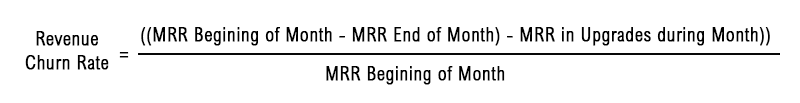

How to calculate Revenue Churn?

Calculating revenue churn is an important part of understanding the financial health of your business. Revenue churn is the percentage of revenue lost from customers who terminate their contracts or downgrade their services, and it can have a major impact on your bottom line. Fortunately, there are a few simple steps you can take to accurately calculate your revenue churn.

The first step is to identify the total amount of revenue lost from customers who have terminated their contracts or downgraded their services. This can include any fees associated with the termination or downgrade, such as cancellation fees.

Once you have the total amount, divide it by the total amount of revenue generated from customers who were active for the same period. This will give you the percentage of revenue churn.

The formula for calculating the revenue churn rate is simple:

It is also important to consider any discounts or incentives that you offer to retain customers. If you offer a discount to customers who renew their contracts, this should be taken into account when calculating your revenue churn rate. By subtracting the total amount of discounts from the total amount of revenue lost from customers who terminated their contracts or downgraded their services, you can get a more accurate picture of your true revenue churn rate.

By following these steps, you can accurately calculate your revenue churn rate and use it to make informed decisions about your business. This information can help you identify areas where you may need to focus more resources in order to retain customers and maximize revenue.

Churn is an important figure for businesses to track, as it can provide insights into customer satisfaction and loyalty. Knowing why customers churn, and how to predict and reduce churn, can help businesses improve their customer retention and grow their customer base.

By understanding why customers churn, using customer surveys, analyzing customer behavior, and using machine learning algorithms to predict churn, and then taking steps to improve customer service, offer better deals or loyalty rewards, improve product or service quality, and proactively address customer issues, businesses can reduce their churn percentage and ensure customer satisfaction.

Author

Mohammed Alqaq

The Founder of Customer Success Middle East | Experienced Customer Success and Professional Services Executive Manager with 17+ years of successful global experience and leadership in delivering Customer Success Management, and Professional Services.